The crypto industry influenced traditional lending by introducing cryptocurrency loans, which benefit borrowers and lenders. Ooki users have more control over their crypto, adding an extra dimension to crypto borrowing.

Ooki crypto loans are safer, more accessible, and more flexible than their fiat counterparts. They are also faster and more efficient than applying for a loan through a bank or other financial institution.

Here’s an in-depth look at Ooki’s advantages.

Borrowing Made Simple

Using Ooki to borrow against your crypto has several advantages. Let's have a look.

1. Flexibility

Crypto loans put the borrower in control by allowing them to specify the amount they wish to borrow, the repayment period, and other fine details. Ooki adds flexibility by eliminating the need for KYC from its users, and anyone can trade on Ooki’s platform.

Ooki is also available on Ethereum, Polygon, the Binance Smart Chain, Arbitrum, and Optimism with plans to launch on further blockchains in the future. Borrowers can leverage their tokens from the listed protocols to access affordable cryptocurrency loans.

2. Instant

Taking out a loan on Ooki is as fast as it can be. Simply connect your wallet, select the network, choose the asset, enter the desired amount, and hit the button! (The time taken depends solely on the response time of the respective network.)

3. Competitive Borrowing Rates

Ooki allows users to participate in non-custodial borrowing and lending pools, which allows for more flexible and secure lending for leveraged trading. It provides reasonable interest rates based on the accessible lending assets and demand from borrowers.

The lending/interest rates adjust to the market to ensure lending pools remain liquid and continually offer reasonable rates. Ooki’s variable interest rate model contributes to its uniqueness among crypto lending platforms.

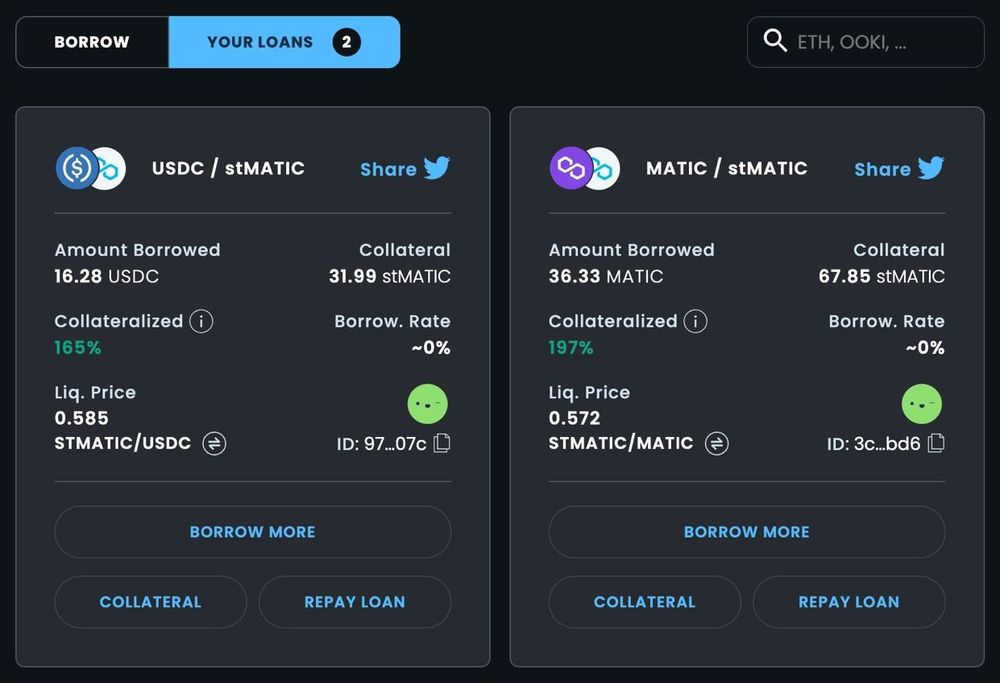

4. Liquidity Tokens as Collateral

Ooki allows you to use your liquidity tokens as collateral for your loans while still earning interests on your assets.

- Wrap your stETH received for your staked ETH on Lido Finance and use it as collateral for your loans.

- Lock your MATIC on Lido Finance, get stMATIC back and use it as collateral for your loans which you can use on Ooki as collateral.

5. Permissionless Listings

Existing decentralized leverage trading protocols offer a few trading pairs; however, Ooki is working on implementing permissionless listings. The crucial feature increases the number of tokens tradable by users.

6. Simplified Trading

Crypto loans circumvent the accessibility issue of traditional financial institutions, which typically require borrowers to prove their identity and provide adequate collateral to secure a loan. However, the model is cumbersome, risky, and discourages blockchain use by demanding extensive KYC details from users.

Ooki’s design ensures functionality and safety without invasion of user privacy; it does not require user identification or run credit checks on financial history (no KYC or credit checks). Ooki also simplifies the trading experience by delivering an easy-to-use and intuitive interface that anyone can understand. The model steps away from the advanced systems that target advanced or professional traders.

To enjoy Ooki’s borrowing services, users need to connect their supported wallet services to Ooki and start the borrowing process.

7. Partial Liquidation

Ooki’s borrowing feature is user-centric as it discourages total liquidation of loan collateral. If a borrower’s collateral value falls below the loan-to-value (LTV) ratio, Ooki partially liquidates the loan security to keep the LTV ratio healthy.

About Ooki

Ooki is a protocol for margin trading, borrowing, lending and staking enabling the building of Decentralized Applications for lenders, borrowers, and traders to interact with the most flexible decentralized finance protocol on multiple blockchains. Ooki is a fully decentralized, community-run DAO, governed by the community vote for all major changes to the protocol. Ooki users can engage in margin trading with up to 15x leverage using a fully decentralized trading platform.