TL;DR

Cryptocurrency wallets play a pivotal role in managing and securing digital assets. Choosing between hardware and software wallets, which include hot and cold wallets, depends on factors like security needs, transaction habits, and the amount of crypto owned.

Introduction to Cryptocurrency Wallets

At its core, a cryptocurrency wallet is a tool that holds your private keys, the critical piece of data used to sign transactions and access your cryptocurrency. These wallets can be broadly divided into two categories - hardware wallets and software wallets, which can further be categorized as hot or cold wallets based on their connection to the internet.

Hardware Wallets: The Secure Haven

A hardware wallet, also known as a cold wallet, is a physical device that securely stores private keys offline. This type of wallet, including popular options like Ledger, Trezor, and Keystone, provides a high level of security since it's immune to cyber threats. The private keys never interact with the internet or your potentially vulnerable computer. You only connect the device to your computer when you want to access your funds or execute a transaction, and you physically approve these transactions on the device itself. However, hardware wallets are often expensive and might not be as convenient for everyday transactions or interacting with decentralized apps (dApps).

Software Wallets: Balancing Convenience and Risk

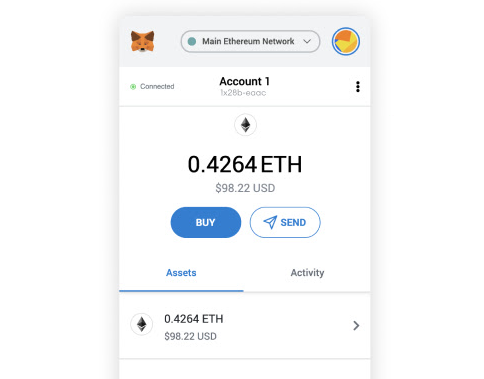

Software wallets or hot wallets are applications stored on your computer or mobile device. They are connected to the internet most of the time, which can make them more susceptible to hacking. These wallets are user-friendly and ideal for frequent transactions, trading, and other daily activities. Some software wallets can even be installed as plugins on web browsers like Chrome or Firefox, allowing users to interact seamlessly with Web3 dApps.

However, the convenience offered by hot wallets can be a double-edged sword. The continuous internet connection could make them a prime target for cyber attacks. This vulnerability underlines the importance of implementing robust security measures, such as strong passwords and regular malware checks.

Smart Wallets: Advanced and Flexible

A specific type of software wallet, known as a smart wallet, offers more complex functionality. These wallets host funds in a smart contract and can apply various conditions and access controls, offering a level of customization that isn't available with traditional wallets.

The Wallet Dilemma: Making Your Choice

Choosing between a hardware wallet or a software wallet depends on multiple factors, such as the amount and types of cryptocurrency you own, the level of security you need, and your transaction habits. Hot wallets might be ideal for small amounts of cryptocurrency used for daily transactions or interacting with dApps, while hardware wallets or paper wallets (a simple form of cold wallet where keys are printed on paper) would be more suitable for storing large amounts of crypto long-term due to their enhanced security.

Moreover, there are also custodial wallets offered by exchanges or other services, where your private keys are managed by a third party. While they offer the convenience of not having to manage your private keys yourself, they come with the inherent risk of relying on the third party's security measures and honesty. In the crypto world, it's often said, "Not your keys, not your coins," which reflects the importance of having full control over your digital assets.

Conclusion: Your Wallet, Your Needs

In the ever-evolving world of cryptocurrency, understanding your wallet options is crucial for safeguarding your digital assets. Your choice should reflect your unique needs and balance convenience with security. Independent wallet reviews and thorough research can provide valuable insight into the best wallet for your needs.

About Ooki

Ooki is a protocol for margin trading, borrowing, lending and staking enabling the building of Decentralized Applications for lenders, borrowers, and traders to interact with the most flexible decentralized finance protocol on multiple blockchains. Ooki is a fully decentralized, community-run DAO, governed by the community vote for all major changes to the protocol. Ooki users can engage in margin trading with up to 15x leverage using a fully decentralized trading platform.