Blockchain technology is constantly evolving. Each new application overcomes the current challenges it faces.

It's almost seems like a race, in other industries, people like to work around problems, but in the crypto industry, participants are rushing to do just that, hoping to lead the next big trend.

Staking is one of those problems. It's nice that you can generate interest with your assets, but the fact that they are locked and you can't do anything else with them is a bit annoying.

And this is where Liquid Staking comes into play.

But what is Liquid Staking?

With Liquid Staking users are able to earn staking incentives via the use of liquid staking protocols, which eliminates the need for locking assets or maintaining staking infrastructure. Tokens may be deposited by users, and in exchange, they will obtain liquid tokens that can be traded.

It’s quite simple. Let’s say you have MATIC and want them to generate interest. What do you do? You search a platform where you can lock up your MATIC and earn interests for it. If you use Lido Finance for this which offers Liquidity Staking, you lock your MATIC but get the same amount of stMATIC (tokenized staked MATIC) back. Which then again you can use for other services like trading, as collateral for loans etc. Thus, you are more adaptable and able to utilize your assets in several ways simultaneously.

Lido Finance is a decentralized platform for liquid staking. Liquid Staking enables you to increase the profits from the utilization of your assets.

Lido on Polygon is a liquid staking solution for MATIC that is backed by some of the most prominent staking providers in the market. With Lido, users may engage in decentralized on-chain financial transactions with their stakes and receive MATIC staking incentives without having to manage their own infrastructure.

LIDO is coming to #Polygon@shard_labs is bringing the Lido Liquid staking solution to Polygon. Users will be able to stake $MATIC & get stMATIC in return for use in other DeFi protocols. Polygon will bring blockchain infrastructure to the masses.

— Polygon - MATIC 💜 (@0xPolygon) September 3, 2021

🌐: https://t.co/RXmyCCEoKg pic.twitter.com/VnPLbbdCEB

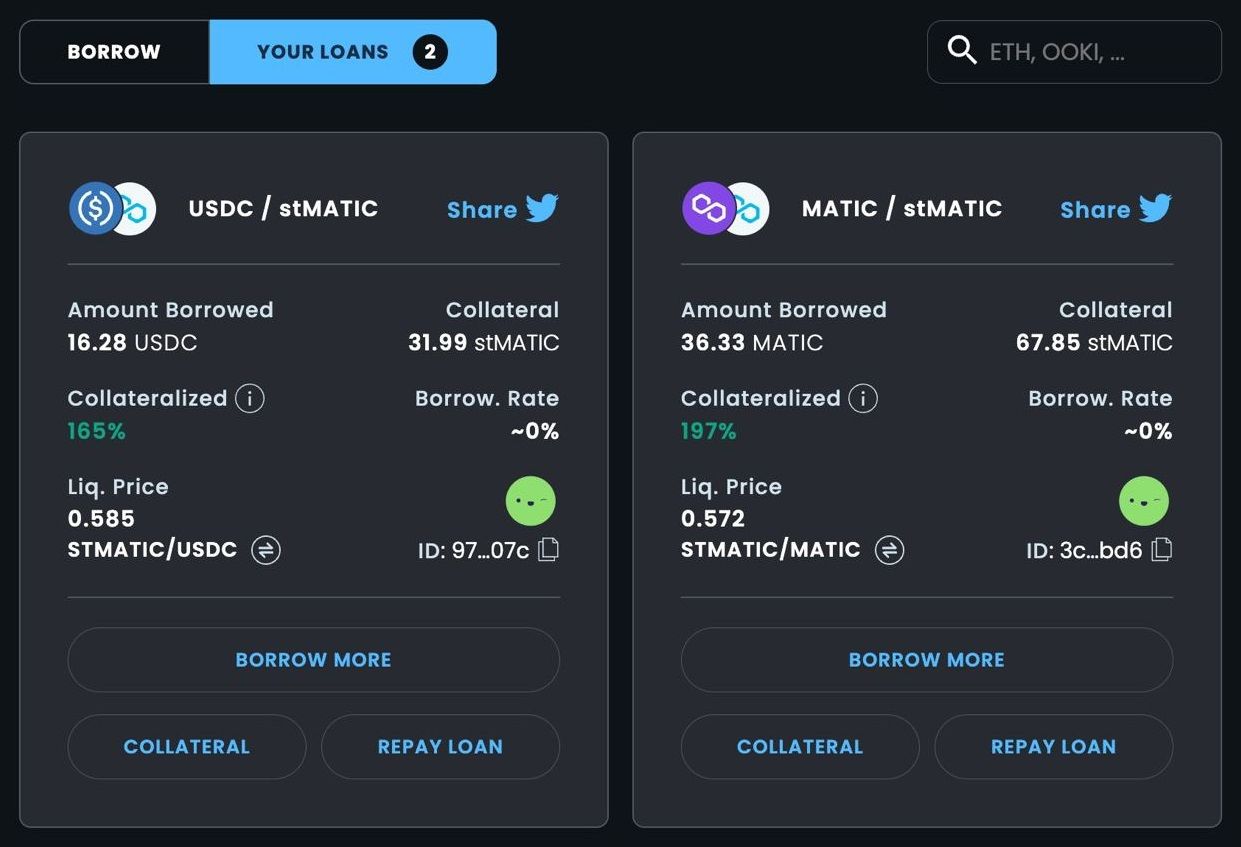

stMATIC as Collateral on Ooki.com

Ooki now allows you to use your stMATIC received for your staked MATIC as collateral for your loans. Furthermore, Ooki works on making it possible for users to trade stMATIC for any borrowable asset.

Good to Know

- Margin requirements for stMATIC against MATIC are 10% initial and 7% maintenance.

- The APR associated with stMATIC is currently 6.3%.

About Ooki

Ooki is a protocol for margin trading, borrowing, lending and staking enabling the building of Decentralized Applications for lenders, borrowers, and traders to interact with the most flexible decentralized finance protocol on multiple blockchains. Ooki is a fully decentralized, community-run DAO, governed by the community vote for all major changes to the protocol. Ooki users can engage in margin trading with up to 15x leverage using a fully decentralized trading platform.