Curve Finance's crvUSD, a decentralized stablecoin, provides a sophisticated approach to collateral management and credit issuance, enhancing stability and efficiency in the cryptocurrency market. As the cryptocurrency market continues to evolve, crvUSD provides stability and efficiency to investors. In this article, we will discuss how crvUSD works, what sets it apart from other stablecoins, and its potential impact on the world of DeFi.

How crvUSD Works

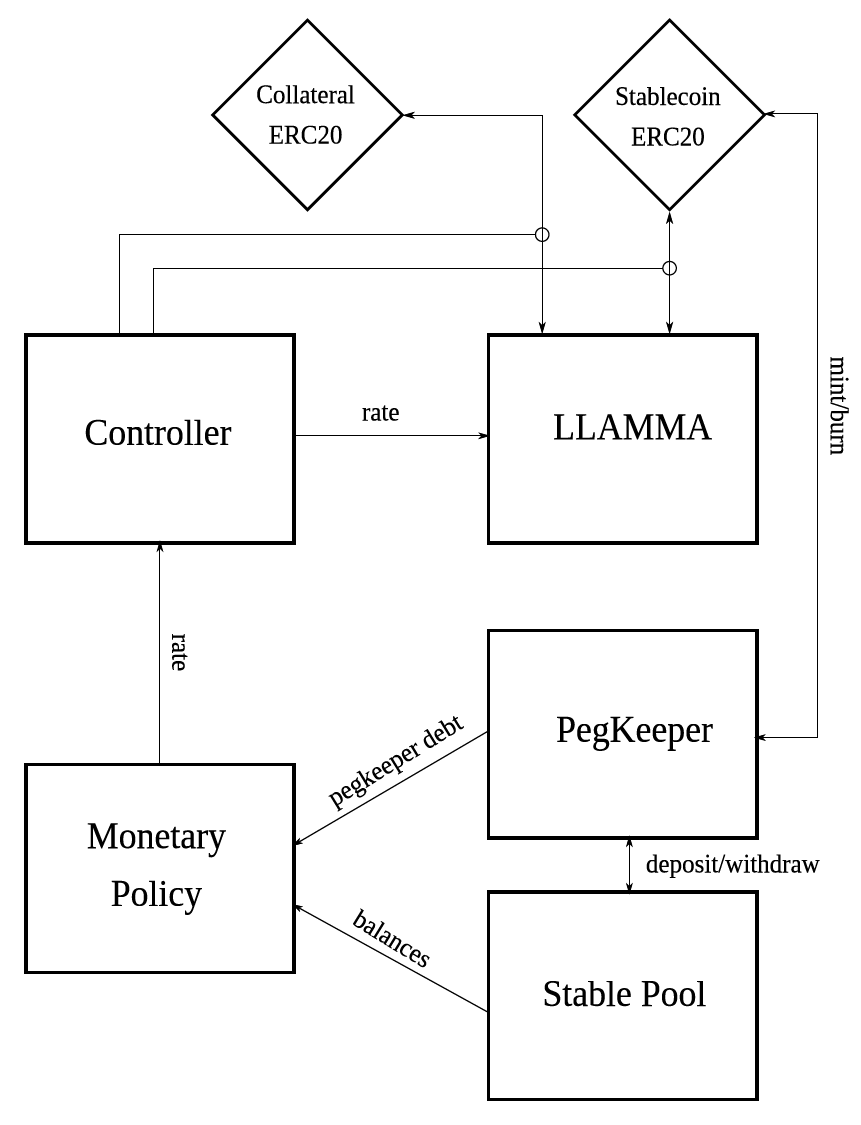

Curve Finance controls the supply of crvUSD using a mint-and-burn mechanism, similar to MakerDAO's DAI. Investors can create crvUSD by opening a collateralized debt position (CDP), depositing digital assets as collateral in Curve's smart contract. When the borrower closes their CDP and claims the collateral, the protocol burns the corresponding amount of stablecoins.

What Sets crvUSD Apart

The main differentiating factor of crvUSD is its unique lending and liquidation algorithm, known as LLAMA. According to the whitepaper, this algorithm regularly rebalances users' collateral to counteract the usual fluctuations of the crypto market. For example, if the price of a collateralized cryptocurrency falls below the liquidation level, the protocol gradually converts it to crvUSD. Once the price recovers, the protocol reconverts the funds to the original asset (de-liquidate).

This mechanism provides a smooth, continuous liquidation process instead of a single, drastic event, which can sometimes cause significant disruptions and losses in lending protocols. Additionally, collateral is stored in an automated market maker pool (AMM), providing liquidity for trading rather than being held in a vault or lending pool. This makes the entire system much more efficient.

Conclusion

The introduction of crvUSD presents a significant step forward for the DeFi ecosystem. Its innovative approach to collateral management and liquidation processes has the potential to attract more investors and provide enhanced stability in the ever-evolving crypto market. As the DeFi landscape continues to grow and mature, crvUSD could become a cornerstone of future developments and innovations.

crvUSD and Ooki

Curve Finance's crvUSD is now available on Ooki for trading and as collateral for borrowing. Joining the ranks of established stablecoins like USDT, USDC, and DAI on the Ethereum network, crvUSD extends the range of stablecoin options for Ooki users, enhancing their trading and lending capabilities within the DeFi ecosystem.

About Ooki

Ooki is a protocol for margin trading, borrowing, lending and staking enabling the building of Decentralized Applications for lenders, borrowers, and traders to interact with the most flexible decentralized finance protocol on multiple blockchains. Ooki is a fully decentralized, community-run DAO, governed by the community vote for all major changes to the protocol. Ooki users can engage in margin trading with up to 15x leverage using a fully decentralized trading platform.