TL;DR

- Both Centralized Exchanges (CEXes) and Decentralized Exchanges (DEXes) facilitate crypto trading.

- The principal difference between CEXes and DEXes is how they handle cryptocurrency custody and control.

- CEXes operate under a central governing authority, which can become a weak point for exploitation.

- Despite addressing some of CEXes' shortcomings, DEXes still have room for improvement.

Cryptocurrency traders often first consider centralized exchanges (CEXes) when deciding to buy or sell cryptocurrencies. CEXes like Binance, Uniswap, and Kraken are key players in the blockchain industry, operating as digital trading centers for cryptocurrencies.

But crypto exchanges can be classified into two categories: centralized and decentralized exchanges. Both categories serve similar purposes but function differently, each offering its own set of pros and cons.

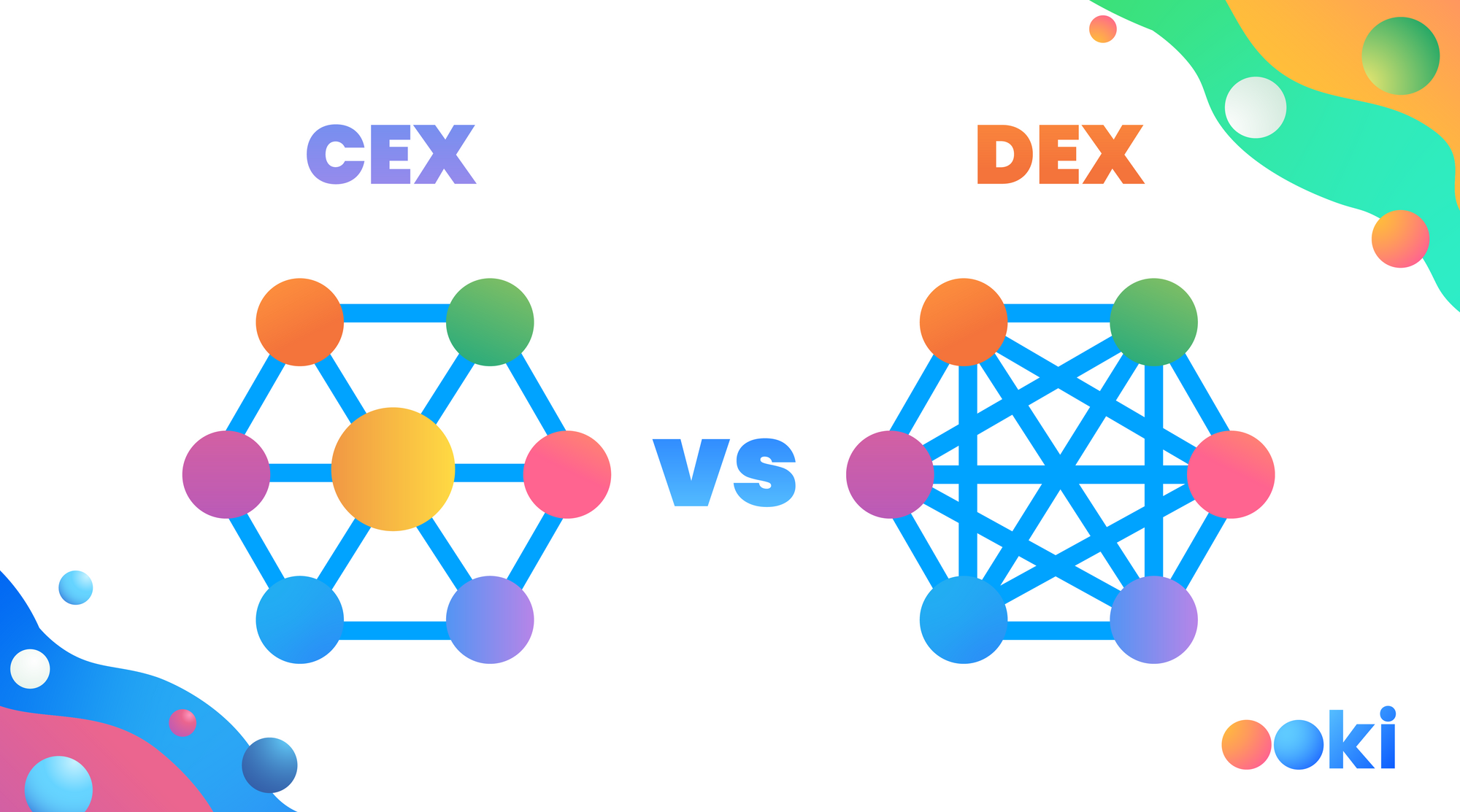

The Core Differences between CEXes and DEXes

Centralized exchanges rely on a central authority to handle transactions within their networks. This central body, typically the exchange owner, maintains a ledger, safeguards user data, executes trades, and performs additional management tasks.

In contrast, decentralized exchanges lack a central authority. Instead, users trade crypto directly over a distributed network of devices, thus minimizing reliance on third parties.

Key Differences to Consider

Selecting the right platform is crucial in elevating one’s crypto trading experience. Both centralized and decentralized platforms provide compelling arguments for their use cases; however, users can consider the following factors before committing to any exchange.

1. PRIVACY

DEXes offer privacy and protection to traders through anonymous peer-to-peer transactions. Unlike CEXes, DEXes have no Know Your Customer (KYC) requirements, thus allowing users to trade while keeping their personal information secure.

2. SECURITY RISKS

CEXes can become targets for hacking and data breaches due to their centralized structure. Conversely, DEXes, by their distributed nature, present a less attractive target for hackers.

3. CUSTODY OF FUNDS

CEXes offer custodial services, while DEXes provide non-custodial solutions, allowing users to retain full control of their funds.

4. USER EXPERIENCE

Centralized exchanges provide a user-centric UX, making them easy to use. Users benefit from paying convenience fees, transaction costs, and other charges through intuitive software prioritizing user experience. However, DEXes such as Ooki offer comparable CEXes UI experience in combination with low fees.

5. LIQUIDITY

While DEXes sometimes struggle with liquidity, CEXes often provide easily accessible liquidity due to their resemblance to traditional financial institutions.

6. CONTROL

Trades in CEXes lose some control to the central authority running the exchange. Price manipulation, limited access to funds, and market forces may cause adverse trading experiences. Decentralized exchanges allow users to control their crypto. The peer-to-peer trading model maintains the crypto owner’s freedom over their funds. A crucial psychological aspect for many users.

7. ASSET DIVERSITY

Cryptocurrencies are required to satisfy security protocols, comply with legal standards, and prove trading activity to enter an exchange, limiting the number of assets listed in CEXs. DEXes, a much wider asset variation, is available.

Despite the high-risk exposure, DEX users may trade in high-demand assets and gain exposure to promising cryptocurrencies.

8. REGULATIONS

Decentralized exchanges bypass some regulatory hurdles; therefore, traders who want to remain anonymous find safe havens in DEXes. On the other hand, centralized exchanges remain under a jurisdiction’s regulatory framework, subjecting users to regulatory requirements.

CEXes vs. DEXes: Which Is Better?

Both types of exchanges come with unique advantages and disadvantages. Users should weigh their specific needs against the pros and cons of each to determine the best platform for their needs.

Ooki provides a practical example of an ideal DEX; it addresses the challenges discussed above. Ooki ...

- tackles high fees, poor user experience, and liquidity issues by developing a user-centric platform.

- delivers an intuitive UI for trading, eliminates rollover fees, and introduces new yield-generating features (margin trading without KYC).

Ooki's DEX example illustrates the numerous possibilities achievable through a DEX done right.

About Ooki

Ooki is a protocol for margin trading, borrowing, lending and staking enabling the building of Decentralized Applications for lenders, borrowers, and traders to interact with the most flexible decentralized finance protocol on multiple blockchains. Ooki is a fully decentralized, community-run DAO, governed by the community vote for all major changes to the protocol. Ooki users can engage in margin trading with up to 15x leverage using a fully decentralized trading platform.