The Pulse of the Cryptocurrency Market

Market cycles, ubiquitous across asset classes, reflect repetitive patterns of growth, stagnation, and decline. These cycles are amplified within the dynamic cryptocurrency market. A standard market cycle consists of four stages: expansion, peak, contraction, and trough. For instance, Bitcoin, the crypto bellwether, has seen numerous cycles since its inception, falling to $15,000 in November 2022 before rising again to $110,000 in January 2025.

Cryptocurrency market cycles differ significantly from their traditional counterparts. A traditional market cycle could span years or decades, while the nascent and volatile cryptocurrency market often compresses a full cycle into a much shorter time frame. The digital nature of cryptocurrencies also exposes them to unique cycle dynamics, informed by different risk and reward parameters.

Influencers and Strategies in Cryptocurrency Market Cycles

Various factors can initiate a cryptocurrency market cycle. Regulatory shifts, technological developments, market sentiment, and broader macroeconomic conditions all play critical roles. A bullish cycle, for example, may be sparked by the United States establishing a Strategic Bitcoin Reserve, signaling institutional confidence and long-term commitment to digital assets. In contrast, tightening regulatory frameworks—such as those recently introduced by the European Union—can dampen market momentum and contribute to contraction phases.

Bitcoin, due to its size and influence, often sets the rhythm for the rest of the cryptocurrency market. A phenomenon known as 'Bitcoin Dominance' or 'Altcoin Season' illustrates how shifts in capital between Bitcoin and alternative coins (altcoins) can influence the market.

Navigating through these cycles requires strategic planning. Diversification, timing, thorough analysis, and disciplined risk management are key components to weathering the storm and capitalizing on upswings.

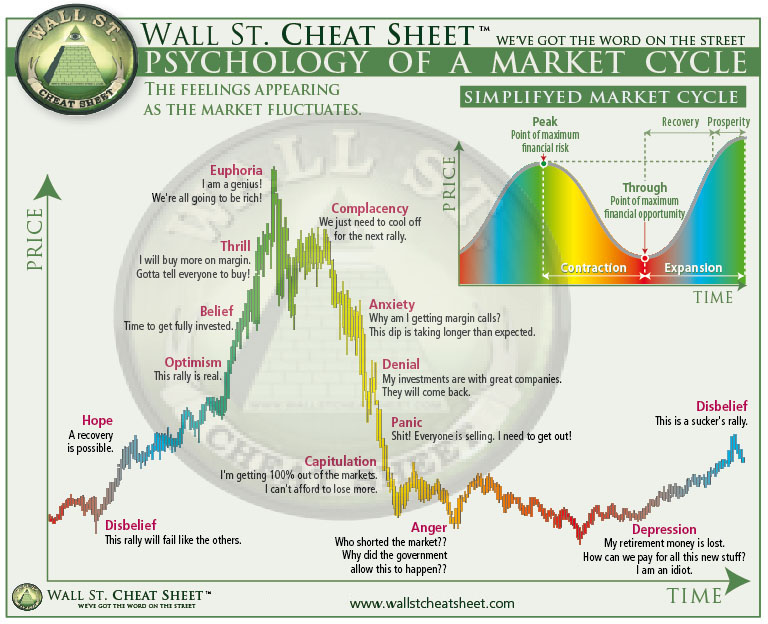

Visualizing Market Cycles: The Wall Street Cheat Sheet

The "Wall Street Cheat Sheet: Psychology of a Market Cycle", often used to visualize the emotional journey of investors, depicts the stages of a market cycle tied to corresponding investor emotions. This graphic captures the euphoria at the peak, anxiety during contraction, depression at the trough, and hope as the cycle resets. Understanding this psychological aspect can help investors maintain a level head, ensuring they make rational rather than emotional decisions.

Identifying Market Cycles in Cryptocurrencies

Identifying market cycles in cryptocurrencies involves a combination of various techniques and understanding of the market:

- Price Action and Trend Analysis: Studying patterns on candlestick charts and watching for key events such as breakouts and reversals is crucial.

- Technical Indicators: Use of indicators like Moving Averages (MA), the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD) can offer crucial signals about potential shifts in market cycles.

- Sentiment Analysis: Tools like Fear & Greed Indexes, social media sentiment analysis, and the overall tone of community discussions can reflect the prevailing mood of the market.

- Understanding Market Cycle Phases: Recognizing the stages of expansion, peak, contraction, and trough provides hints about the current position within a cycle.

- Bitcoin's Halving Events: In the crypto market, Bitcoin's halving events, which occur approximately every four years, often mark the onset of a new bullish cycle.

- Market News and Events: Regulatory changes, major technological updates, and economic shifts can dramatically impact market cycles.

No single indicator guarantees the prediction of market cycles. Instead, a combination of these techniques, backed by a firm grasp of market fundamentals and a disciplined investment strategy, provides the best approach.

Conclusion

The world of cryptocurrency investing is often likened to a roller coaster ride, characterized by sharp inclines and steep drops. However, understanding the rhythms of market cycles can prepare investors to face this volatility. Despite their intimidating appearance, market cycles bring potential growth and opportunity, marking the rise and fall as inherent beats of the market's heart.

About Ooki

Ooki is a protocol for margin trading, borrowing, lending and staking enabling the building of Decentralized Applications for lenders, borrowers, and traders to interact with the most flexible decentralized finance protocol on multiple blockchains. Ooki is a fully decentralized, community-run DAO, governed by the community vote for all major changes to the protocol. Ooki users can engage in margin trading with up to 15x leverage using a fully decentralized trading platform.